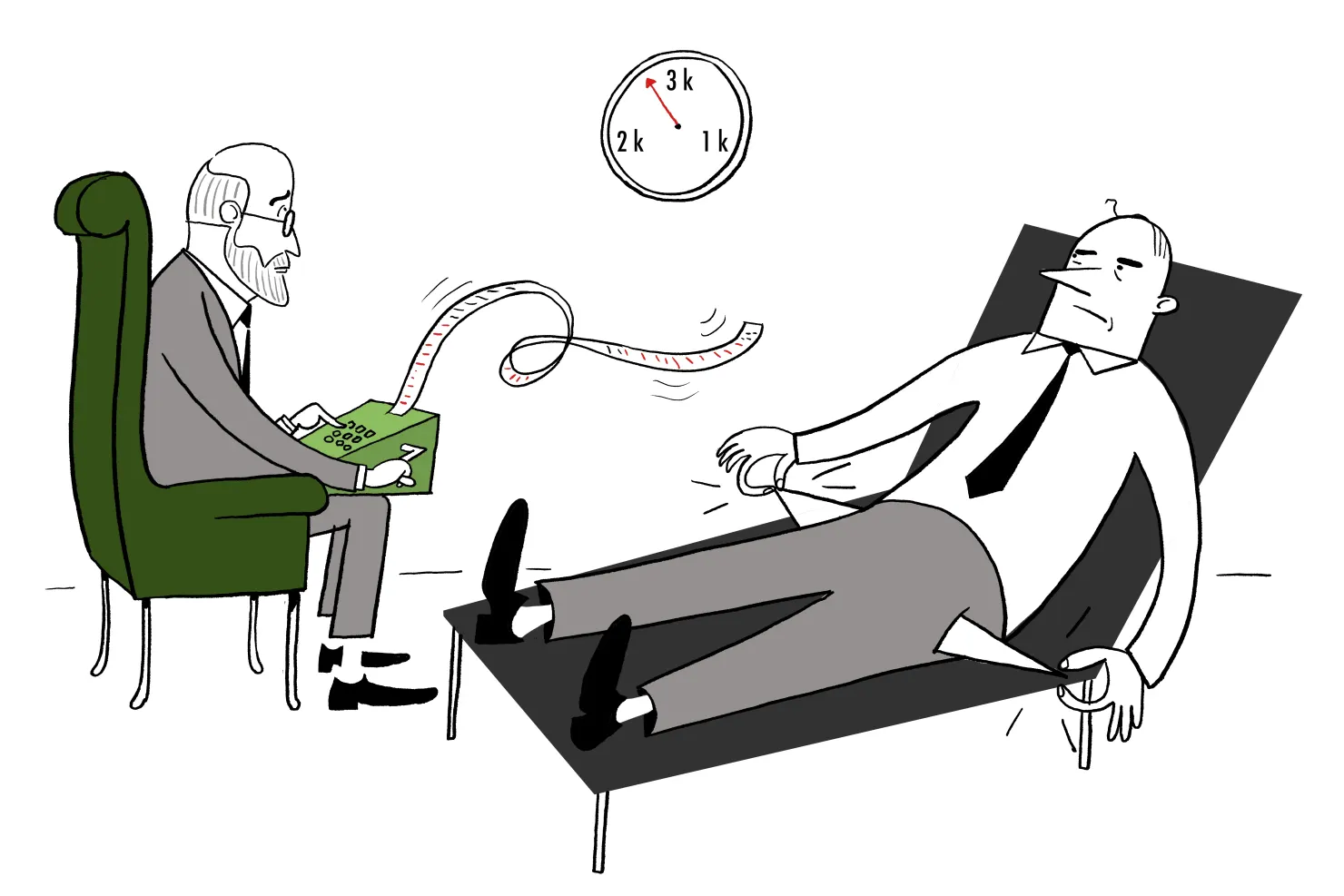

$3500 for financial advice? Tell ’em they’re dreaming

I have received financial advice on two occasions in my life and paid a total of just $550.

The first time, I spoke face-to-face with a financial planner employed by the bank that gave me my first mortgage. I had expressed an interest in learning more about income-protection insurance and a session was organised for a discounted rate of $550.

I bombarded the poor man for more than an hour with intricate questions about insurance underwriting and, some weeks later, I received my official and lengthy “statement of advice”.

I didn’t ultimately take out the insurance, but I did benefit greatly from getting a hot tip about using previous years’ concessional contributions caps for superannuation.

On the second occasion, I accessed some free advice organised through my super fund via the phone. We discussed insurance options in super and also my risk profile, with a view to changing my “growth” portfolio investment option for my super. Again, I didn’t actually act on any of the recommendations, but I certainly appreciated the chance to talk through my options.

Truth is, I don’t have particularly complex financial affairs, nor excessive amounts of money to manage.

What I really needed – and what most Australians need – was a fairly generic level of guidance on good financial housekeeping.

Unfortunately, accessing any sort of financial advice right now is prohibitively expensive for most Aussies.

Just one-in-10 adults receive financial advice, according to the latest survey of fees by Advisor Ratings. That’s not surprising when you learn that the median fee for advice is $3529, up a whopping 40 per cent over the three years to December 2021.